Financial statements are essential documents used by investors, analysts, and creditors to evaluate a company’s financial status and earning potential. Among the three financial statements, the balance sheet and cash flow statement stand out. The balance sheet presents what a company owns and owes, while the cash flow statement records cash activities over time.

Balance Sheet

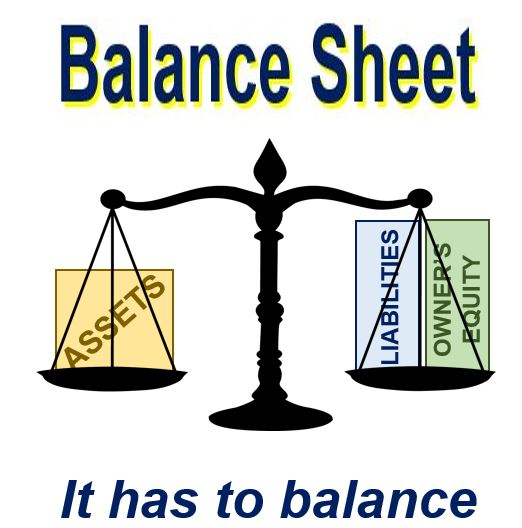

A balance sheet summarizes a company’s assets, liabilities, and shareholders’ equity at a specific period, usually at the end of a quarter or year. Assets show what a company owns, liabilities indicate what it owes, and shareholders’ equity represents the amount invested by shareholders.

The balance sheet can be broken down into three parts, including assets, liabilities, and owners’ equity. To calculate a balance sheet, total assets are added to the sum of total liabilities and shareholders’ equity. The balance sheet equation should always be in balance.

The balance sheet contains different items such as cash and cash equivalents, marketable securities, accounts receivables, and inventory under assets. Under liabilities, there is long-term debt, rent, taxes, utilities payable, wages payable, and dividends payable. Shareholders’ equity lists the net value or book value of a company, including retained earnings.

Cash Flow Statement

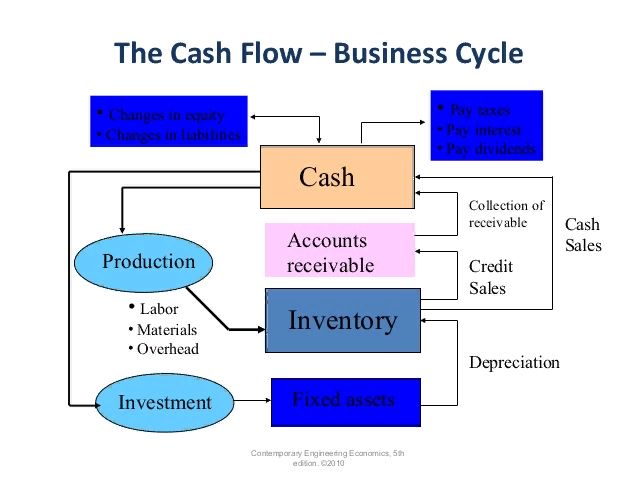

The cash flow statement shows the amount of cash and cash equivalents entering and leaving a company. It measures a company’s ability to manage and generate cash to fund operating expenses and pay its debt obligations. The cash flow statement has three sections: cash from operating activities, cash from investing activities, and cash from financing activities.

Operating activities reflect how much cash is generated from the sale of a company’s products or services. Investing activities show incoming or outgoing cash from a company’s long-term investments, while financing activities indicate cash from investors or banks and payments made to shareholders.

Importance of Balance Sheet and Cash Flow Statement

Balance sheets and cash flow statements are crucial in evaluating and making important decisions concerning a business. For business owners, these statements can help track business growth and estimate tax payments. For investors and analysts, the balance sheet and cash flow statement can aid in evaluating a company’s financial stability and potential returns.

In conclusion, while the balance sheet summarizes a company’s financial position at a specific point, the cash flow statement shows how cash is generated and used over a particular period. Understanding both statements is vital in making informed financial decisions.